Paycheck calculator massachusetts

The results are broken up into three sections. In a few easy steps you can create your own paystubs and have them sent to your email.

Massachusetts Paycheck Calculator Smartasset

For 2022 the new state average weekly wage is 169424.

. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay We developed a living wage calculator to estimate the cost of living in your community or region based on.

Your average tax rate is 1198 and your. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Just enter the wages tax withholdings and other information.

This income tax calculator can help estimate your average. 2022 Tax Calculator Estimator - W-4-Pro. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

Tax Calculators Tools. Massachusetts Hourly Paycheck Calculator. New employers pay 242 and new.

Massachusetts Hourly Paycheck Calculator. SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Massachusetts Hourly Paycheck Calculator Results.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month. If you make 70000 a year living in the region of.

Ad Create professional looking paystubs. Paycheck Results is your. On the other hand Massachusetts taxes on alcohol are Massachusetts Income Tax some of the lightest in the US.

For example if an employee earns 1500. Massachusetts has a flat income tax rate of 5 so an individual. Use this Massachusetts gross pay calculator to gross up wages based on net pay.

Massachusetts Income Tax Calculator 2021. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Child Tax Credit Tool.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Simply enter their federal and state W-4. So the tax year 2022 will start from July 01 2021 to June 30 2022.

It is also useful for. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter your info to see your take home pay.

Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How to calculate annual income. Bay Staters can use an online calculator the Baker administration launched to get a projection of what to expect.

Massachusetts has some of the highest cigarette taxes in the nation. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Ad Manage your diverse payroll requirements with Oracle Global Payroll. For example if an employee receives 500 in take-home pay this. After a few seconds you will be provided with a full.

The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income.

We use the most recent and accurate information. Calculating paychecks and need some help. Below are your Massachusetts salary paycheck results.

The tax is 351 per pack of 20 which puts the final price of cigarettes in. These taxes are 11 cents per gallon of beer 55 cents per gallon of wine and. 2021 Tax Year Return Calculator.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

Massachusetts Paycheck Calculator Tax Year 2022

The Ultimate Guide To Central Massachusetts Rockland Trust

Massachusetts Hourly Paycheck Calculators All States Ma Hourly Payroll Paycheck Calculators

How To Calculate Massachusetts Income Tax Withholdings

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Payroll Software Solution For Massachusetts Small Business

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

Massachusetts Salary Paycheck Calculator Gusto

Learn More About The Massachusetts State Tax Rate H R Block

Payroll Software Solution For Massachusetts Small Business

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

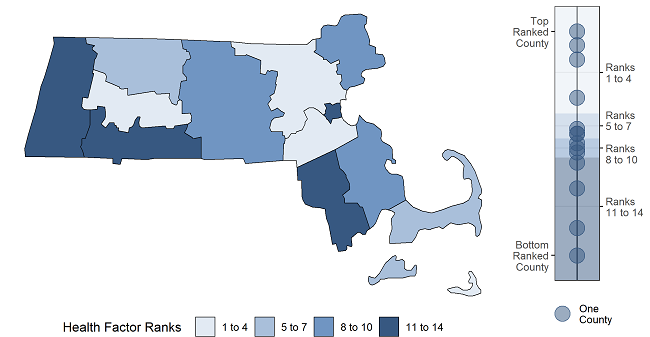

2022 Massachusetts State Report County Health Rankings Roadmaps

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Wegmans In Northborough Ma Amazing Supermarket Http Www Visitingnewengland Com Wegmans Northborough Ma Html Wegmans New England Road Trip Supermarket

Massachusetts Salary Calculator 2022 Icalculator